MSP Profit Challenges

By Gaidar Magdanurov · 30 July 2023

A few weeks ago, we talked with Dave Sobel (I strongly recommend his podcast to people interested in the managed services market, by the way) about the MSP market and our observations of new trends in the market. Among the topics we discussed were the present-day challenges for the smaller MSPs. Since that conversation, I have been asking MSPs I am talking to about their challenges at every suitable opportunity, and the general theme seems to be the same across the world.

Declining profits

For the smaller MSPs, the central issue of the last 3–6 months is the decline in profits. Their customers are going out of business, decreasing their IT budgets, and requesting to downgrade their service level or demand discounts. Some MSPs shared stories of customers not paying the bills and suggested going to court to collect the payment or offering only a partial payment.

Businesses that depend heavily on foot traffic around major office buildings suffer, as fewer people go to the office and fewer people turn to them to consume their services and goods. This impacts the MSPs. Vendors serving those who depend on foot traffic also suffer losses, which affects the MSPs serving them.

Many SMBs struggle with timely cash collections, which leads to cashflow gaps. As a result, they cut expenses and reduce expenses, often including IT spending in the list of expenses to cut.

When everything works, MSPs are rarely visible, and business owners start to think they don’t need to pay them as much as they did.

Simplified illustration

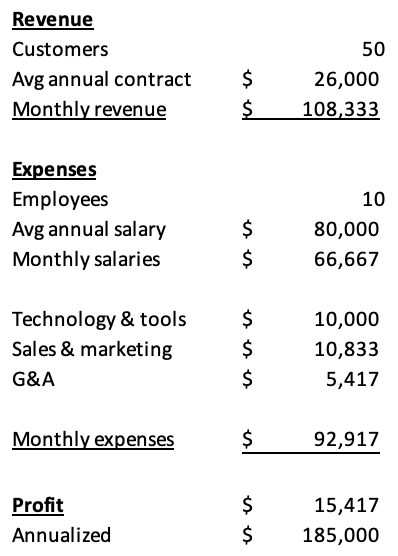

Let’s examine how changes in a smaller US-based MSP’s customer base impact its profits using a simplified business model.

Their “pre-pandemic” model allowed them to collect 14% profit, run a company with 10 highly skilled engineers, and spend about 10% on sales and marketing to constantly source new leads for customers to replace the churn that, sadly, happens every year. Their administrative costs are around 5%, and they spend around $10,000 monthly on the technology and tools—internal and the software they deploy with their customers.

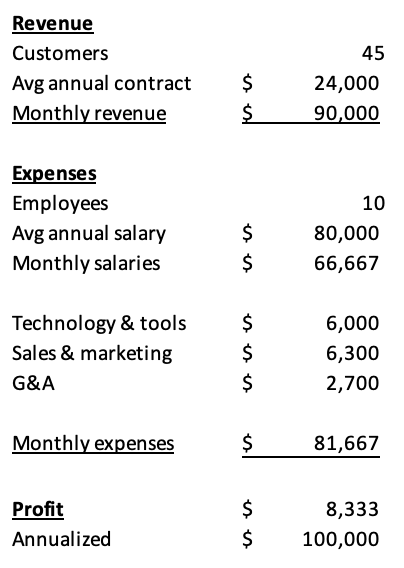

During the pandemic, due to the increased economic pressure, they lost 10% of their customer base, and the remaining customers requested to reduce their contracts. The MSP was really good at pitching the value of their services, and the reduction on average was not extreme — as they were able to replace some of the customers that were churning and maintain the same or slightly lower contract value for those who stayed, with average annual contract value falling from $26,000 to $24,000. However, combined with the churn of customers, profits went to zero. To mitigate the impact, they reduced the technology cost, switching to free tools and reducing the services they deploy to their customers to $6,000 monthly. They reduced G&A to 3% and sales & marketing expenses to 7% (as they have tested that going below that generates not enough leads to sign up any new customers, and in their situation, they desperately need to replenish their customer base). This brought their margins to 9% and made the owner nervous; for any future redaction, she would have to reduce the number of engineers, most of whom worked for her for over 6 years and became her second family.

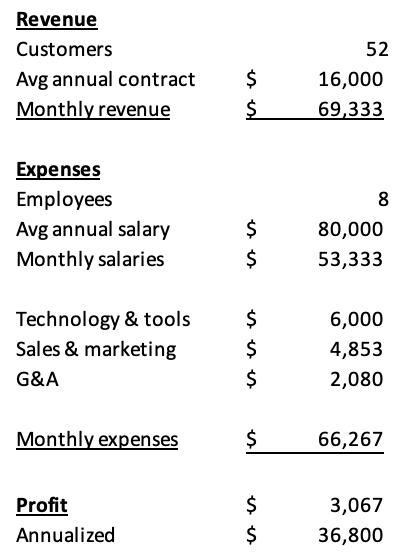

In the last year, the churn continued. Some old customers got out of business; some switched to MSPs with much lower costs (speaking of loyalty, huh). Even though marketing activities helped recruit new customers and replenish the customer base, new customers came with significantly lower contract values, driving the average numbers down. Profit dropped, and the owner had to decide to remove two people from the company. The profit margin is just 4%. However, further reduction in staff will make it extremely difficult to maintain the customers’ infrastructure. It would increase the risk of losing them and, eventually, going out of business.

So, what is going to happen next?

Going after the big fish

Looking at the customer base, the MSP owner realized that a few larger customers have significantly larger contracts. They have more employees and more workloads to manage, and their business is growing. Therefore, the owner focused on upselling additional services and offering strategic IT guidance to those customers to increase their contracts.

The offer includes additional security and disaster recovery services and higher SLAs for issue resolution. Refresh their network infrastructure and hardware. Introduction of new cloud-based services for employee time tracking, desk and conference room sharing, migration of the on-premises email system to the Cloud and many others.

The direction is to collect more money from the bigger customers.

Scaling the operations

Another avenue to increase revenue is to support more smaller customers. The issue is that the contract value is small; while they may take up a significant capacity of technicians, more is needed to justify the value those customers bring. Also, customers constantly looking for cheaper service are not loyal, and onboarding and off-boarding become expensive.

The only way to scale the business and include customers with smaller contracts is to implement automation and standardization where possible—standardizing the technology stack and increasing the operational maturity.

Consolidating tools and introducing a standard technology stack decreases technicians’ time and allows the same team to handle significantly more workloads. Automating most tasks allows for uniformly taking care of most customers, freeing up more time for technicians.

A side effect is that technicians with more free time from their day-to-day jobs can participate more actively in marketing activities—going to local events, talking to prospects, and participating in online communities of business owners.

Light at the end of the tunnel

From the collective image example above, the MSP found a way to improve profits, and they are willing to continue bringing profits back to the pre-pandemic level. Given that they can scale, they are looking into acquiring customers lost by other MSPs who could not accommodate lower contract values or went out of business because of the shrinking profits.

The story’s moral is that scalability through automation and standardization becomes necessary. For MSPs without unique services and working at scale, scalability is crucial for survival.